by John Dodge

The Value of Time

The Value of Time

Two 25 year old buddies were having a beer after work when the subject of retirement came up. Even though that event seemed light years away, they talked about their dreams and plans. One guy wanted to travel the world. The other wanted to turn his hobby into a small business. The next day, the travelling guy opened an IRA with $2000. He continued to put in $2000 a year for the next ten years, and then he stopped. On that day, his buddy finally opened his first IRA and deposited $2000 annually for the next thirty years. You can sniff the punch line, can't you? The friend with the ten-year head start became the richer person in the end...by a considerable margin.

Time has a totally miraculous effect on even small amounts of money. The younger you are, the sooner you begin to invest a portion of every paycheck, the more time that money has to compound and grow into a substantial sum. Start early enough, even with a modest investment plan, and it’s a realistic goal to retire a millionaire, or fund your own start up company, or save for the down payment on a house, or (fill in your personal dream here).

If you’re like most readers of this magazine, you’re a single person in your twenties or early thirties. You work hard, you play hard, and you make fairly good money—though not as much as you’d like. Even though I’m not a gambler, I’ll wager they didn’t teach you much about personal finance in school. I’ll also bet you’re smart enough to know that you’ll never get rich on your salary alone. To do that you need to invest. This article details the basics of investing and offers a clear plan of action. Follow the plan and you’ll become a much wealthier individual. It doesn’t require much money. What’s required is a little bit of discipline and a lot of time. The more time the better.

Speaking of time, it’s time for a disclaimer: I’m an expert amateur, not a certified public accountant, professional financial analyst, or tax expert. I’ve been investing for ten years and seriously interested in personal finance issues for fifteen more. Everything that I relate from my twenty-five years’ money management experience is true to the facts, as I know them. That disclaimed, I urge you to do your own thinking and research.

Let’s start by going the traditional Top Ten format one better. I submit for your approval and for your refrigerator door:

John Dodge’s Eleven Steps to Financial Success:

1.Understand the value of time

2.Spend less than you earn

3.Pay yourself first—the 10% solution

4.Track your dough, avoid Mr. ATM

5.Pay down the plastic

6.Understand risk and reward

7.Make a plan, set a target

8.Maximize your 401(k) and new Roth IRA

9.Re-evaluate every six months

10.The best tax shelter there is

11.The biggest risk of all

Understanding the concept behind the value of time is easy. To put that concept to work, we have to accept the next step:

Step 2: Spend less than you earn

There are four ways to get money: steal it, marry it, inherit it, or earn it. Most of us make our living the hard way, with a paycheck every other week. Problem is, there’s often too much month at the end of the money. Our credit card debt is expensive and growing. There’s little or no back-up cash for emergencies, and no financial plan, therefore no power to turn the situation around.

There’s no trick to this, so let’s just face facts: until you spend less than you earn, until you live within your means, until you learn to prioritize, you’ll always live paycheck to paycheck. I’ll borrow a good example of spending priorities from my old Boston associate, financial guru Jonathan Pond. Let’s say you just love to drive new cars. If you buy or lease a new car every three years instead of every ten, over the course of your lifetime, your auto eroticism will cost you an extra $385,000. There are a million other examples. First-run movies cost 150% more than videos, generic aspirin costs 40% less than brand name aspirin for the exact same product, and so on. Each financial decision you make, no matter how small, represents your priorities and values. And each time you spend more than you need to, you rob yourself of a growth opportunity.

Enough guilt already. Here’s an easy system to help you break the spend-everything-you-make cycle. It’s automatic, relatively painless, and it works:

Step 3: Pay yourself first—the 10% solution

The average person goes about spending and saving in exactly that order. Once we’ve paid for rent, groceries, car, credit cards, recreation, and the cash-sucking black hole of the ATM, there’s usually nothing left to save. Do this instead: reverse your bill-paying priority and pay yourself first. Let’s say you make $500 a week. Could you live on just 5% less, on $475? No problem. How about $450? A bit tougher, but I’m sure you could manage. That’s good, because this 10% solution is going to change your entire financial future.

Now is when you begin to use the single most important tool in your Get Rich Toolbox: the Automatic Investment Plan. Go to your bank or any mutual fund company and open a new and separate money market account. Tell the bank to automatically transfer $50 (or 10% of your monthly salary) from your checking account into your new money market account every month. What you don’t see you don’t miss, and what you can’t get at, you can’t spend. If 10% is too painful, start with 5% and work up from there. The commitment is flexible. If you get into a temporary jam, you can usually stop or pause these plans with a phone call. But resist the temptation and pretty soon this “off the top, not the bottom” tactic becomes habitual. Make this 10% solution a way of life, and you’re on your way to a much more secure and independent future, maybe not filled with private jets and penthouses, but a nice car, house, vacations, and no major money worries. To navigate to that bright future, we have work to do today:

Step 4: Follow the money

We’ll start by using the automatic investment plan and money market account to create a job safety net, a minimum three-month emergency fund to cover you in case something unexpected happens. Get out the checkbook and calculate your living expenses for a 90-day period, just the essentials like food, shelter, and car payment. That number is your first investment goal. Once the emergency account is funded and you’re better protected from job insecurity, we’ll move on to the next automatic investment goal. First, let’s play Follow the Dollar:

Tracking your dough, knowing where it goes, is the basis of good money management. Try to follow every dollar during this first three-month exercise. If you have a computer, use a program like Quicken or Microsoft Money. Both make budgeting and tracking much easier. A spreadsheet will also do the job. If none of these tools are available, a pencil and a calculator work just fine. Patterns in your spending will quickly emerge. Look for ways to tighten up without too much pain. Watch particularly for holes in the boat where money drains out without you having anything to show for it. I guarantee the biggest hole will be the ATM machine. People withdraw hundreds of dollars every month and are generally clueless about where the money goes because there’s no paper trail. Since you can’t manage what you can’t measure, try using checks, debit cards, and credit cards as much as possible. You’ll always need cash for small purchases, but keep it to a minimum. When it comes to managing money, Mr. ATM is not your friend.

Step 5: Pay down the plastic

Your credit card isn’t necessarily your friend either. “No fee” cards are great if you regularly pay the balance in full, but doing so requires more discipline than most of us have. Millions of people float thousands of dollars of very expensive credit card debt every month, which is why those attractive offers keep coming in the mail.

Here’s a quick reality check to determine if you’ve got a problem with plastic:

1.Do you routinely pay the required monthly minimum and no more?|

2.Have you ever used your credit card for a cash advance to pay that minimum?

3.Do you regularly use the card to pad until the next paycheck?

If this sounds too familiar, try this tactic to get out from under credit card debt. If you roll over a whopper bill to the tune of 13-18% interest every month, continue to invest in your money market account. Then apply the amount over and above your basic emergency fund to paying down the plastic. To maintain the discipline, take a pair of scissors and cut your collection down to two major cards.

Debt’s not necessarily a bad thing. If it’s productive debt, it can even play a positive role. Follow this rule of thumb to stay on the good side of that equation: borrow for stuff that makes money; pay cash for everything else. Once your emergency account has accumulated three month’s basic living expenses and you feel okay about the level of credit card debt you’re carrying, it’s time to switch to the next automatic investment plan. To clearly understand the next important step, we first need to understand the nature of risk:

Step 6: Risk and reward

These two concepts are tied together like cause and effect, like Scully and Mulder. The more risky an investment, the greater the opportunity for profit or loss. Conversely, the more guarantees an investment has, the safer the bet, the lower the potential return. A good case in point is your bank savings account. Today that account earns around 3%. Inflation, the rate at which the price of everything goes up, also averages around 3% per year. So don’t these two numbers effectively cancel each other? They do. That’s why your “guaranteed” savings account is such a lousy investment.

As you climb up the ladder of risk and reward, the protection ends and the potential for profit goes up. With it goes the chance that you’ll lose money. While money markets aren’t FDIC-insured like your bank savings or checking account, I’ve never heard of a money market fund that lost money. Bonds are more risky. Riskiest of all are stocks. Prices blow up and down every day, often based on completely irrational factors. But investments that seem risky in the short run can actually outperform other kinds of investments over the long term. We’ll discuss this apparent contradiction in step seven.

What you get for your risk

Here’s a comparison chart with historical average rates of return for the basic investment categories:

* Money market funds average 5-6%. Very low risk and well suited to short-term needs.

* Bonds and bond funds average 8-9%. When you own a bond, in effect you loan money to cities, governments, or corporations, and they pay you back with interest. Bond prices fluctuate somewhat, so there’s a chance that the $10 you invest today could be worth $9.75 next week. Or $10.25. A good low to mid-level risk investment depending on the individual bond or fund. A suitable vehicle for mid-term goals 2-4 years away.

* Stocks and stock mutual funds are the highest risk investment in the group, averaging around 11% over time. When you own shares, you literally own a piece of the companies behind those shares. Stock earnings over the past fifteen years have been statistically off the charts, and the likelihood of continued annual returns of 20-30% is pretty slim. To smooth out the ups and downs of the market, five years is a good minimum time frame for your stock investments. If your window is shorter than that, don’t go into stocks.

Three Important Answers

But don’t stocks go down? Don’t markets crash? Don’t people lose money? The answers are yes, yes, and yes. But it’s what happens afterward that counts. Stocks always rebound from these losses. Stocks could get hammered in any given year, but in time they always recover more ground than they give up. In the aftermath of every market crash on record, the people who held onto their stock, who didn’t panic and sell when prices were down, gained back their paper losses and then some. If fact, those that faired best were those who viewed a crash as a temporary discount and “stocked up” during the sale! The important point to remember is that through good years and bad, stocks return an average of 11% per year. Over time you will make more money in stocks than you will with either bonds or cash.

As with the rest of life, self-knowledge is important to your invest-ment strategy. Are you a gambler, willing (and hopefully able) to risk it all on a high risk/high reward deal? Or does the idea of losing money, even on paper, churn your stomach and keep you awake at night? Nothing is worth losing sleep over, so honestly figure out your appetite for risk and make a plan you can live with.

Step 7: Make a plan, set a target

A dream without a plan is just a wish. So let’s get this investment dream off the ground. Imagine three piles of money. You already have your emergency cash parked in a low-risk money market fund. The second stack is mid-term money you’ll need for larger purchases or plans 2-3 years from now. We’ll buy bonds with that. Your long-term money goes into stocks to cover goals from five years on out. To accomplish both the mid and long term goals, we’ll invest in mutual funds.

Simply, here’s how mutual funds work. You and thousands of other individual investors pool your money into a professionally managed account. The mutual fund then buys shares directly in companies, while you buy shares in the fund. Presumably, your time is best spent becoming an expert at your job, so mutual funds are a great way for small investors to participate in the market while getting the advantage of hands-on, full-time, experienced money management. They’re also a great way to get diversification. Different companies within an industry and different industries within the larger economy can be up or down depending on where we are in the business cycle. Successful investing in a few individual stocks requires that you follow this game very closely. Alternately, investing though mutual funds helps protect you from having “all your eggs in one basket.”

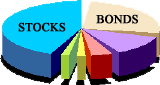

Pie time

Pie time

Now it’s time to divide the pie among money market funds, bond funds, and stock funds. Finance guys call this asset allocation. Your money market account is covered, so your new automatic 10% solution focuses on a mix of stocks and bonds. A conservative investment rule of thumb is to “own your age” in bonds. If you’re 25 years old, three-quarters of your investments should be in stocks, one quarter in bonds; shifting with time, the same portfolio at age 40 should be adjusted to hold 60% stocks, etc. The most simple, conservative scenario for a thirty year-old that automatically invests $100 per month is to have two funds, with $70 directed to the stock fund and $30 to the bond fund. A riskier and potentially more profitable ratio would be 80% invested in stocks and 20% in bonds. The younger you are, the longer your time frame, the more risk you can afford to take. It’s not unusual for someone in their twenties to be 100% invested in stocks or stock funds.

Even within the stock and bond categories, funds can range from low-risk conservative, to very high-risk aggressive. For example, you can find a high-yielding junk bond fund that’s much riskier than a conservative stock fund. So generalizations about categories don’t work. You have to drill down into the details and, again, factor in your goals and your capacity to handle risk.

Get in, stay in

Nobody can accurately predict the direction of the stock market. “Market timers” who claim to have a system that alerts them exactly when to get in and when to get out again to maximize profits are lying. The problem with market timing is that the best and worst performances of the entire year happen only on a handful of days. If you bet wrong and you’re not invested during the upswing, you can lose the whole year’s gains. Conversely, if you get in when the market is going down, you lose again. Better to just get in and stay put for the long haul. Here’s the best way:

By automatically investing the same amount of money month in and month out, your dollars by more fund shares when the market drops and prices are down, and fewer shares when the market is rising. This dollar cost averaging smooths out the peaks and valleys and protects you from quick in/out strategies which too often result in a “buy high, sell low” scenario.

Step 8: Maximize your 401(k) and new Roth IRA

Before getting into taxable mutual funds, it only makes sense to fund your tax-sheltered accounts first. Less money for the IRS means more money for you. Start by putting the maximum into your company’s 401(k) plan. There are three reasons for doing this:

1.The allowable amount is much higher than with an IRA.

2.Your company may offer an incentive and match every dollar that you put in with, say, 25 cents. This is totally free money. If someone offers you $1.25 for your dollar, you should probably take it.

3.Even if the company doesn’t have a matching plan, the 401(k) is a smart deal because your contributions are made with pretax dollars. This means that if you earn ten bucks and shelter two in your 401(k), you’re only taxed on eight bucks income.

401(k) accounts are portable—if you leave the company you can take your account with you and “roll it over” directly into another account. The money continues to grow tax-free until you take it out. The rules on 401(k) withdrawals are similar to those governing the IRA. There’s a 10% penalty for withdrawing the money prior to age 59 ½ except under certain conditions, such as a down payment on a first home, medical emergencies, and college tuition. Your HR/personnel person will tell you more details, but if your company offers a 401(k) plan, I strongly urge you to enroll as soon as possible.

Once you’ve contributed the maximum to your 401(k), it’s time for the second tax-advantaged plan. You may have heard about the new Roth IRA. This plan’s biggest advantage is tax-free withdrawals. Unlike a regular IRA, there is no tax due on the Roth when you withdraw money at retirement. If you’re starting today, the Roth IRA is definitely the best way to go.

A quick word on retirement, just in case you think it’s strange to be even thinking about retirement at this point in your life. Consider that the average American male lives to be 78 years old; females live longer. Advances in health science and care keep extending our lives, so God willing, you’ll beat the average. It would be smart to plan like you’re going to live to be 90. Unless you also plan to live downtown under a bridge, you’ll probably need 75% of your regular income to get by. Think very carefully about where you expect this money to come from. The government? Your employer? Or yourself? Of these three, who do you trust most to protect your interests?

Once the 401(k) and Roth IRA accounts are up to speed, it’s time to turn your 10% solution to a taxable mutual fund. With over 8000 mutual funds to choose from, you can narrow the range by starting with one of the established fund families. Big names include Fidelity, Scudder, T. Rowe Price, and Vanguard. All are reputable companies with automatic investment plans and 800 numbers. Call and ask for literature on their money market, bond funds, stock funds, and any general investment information they can provide. When it arrives, read everything carefully and ask questions.

Step 9: Re-evaluate your situation every six months

Needs change, so you should never leave your investment plan on cruise control. Every six months or so, review and evaluate your accounts. Can you take on more risk? If so, it’s time to switch to a more aggressive stock fund. Or perhaps you need to settle for lower but more secure and predictable returns. Time for you to adjust the mix to a higher ratio of bonds.

At each of these review sessions, try to increase your automatic investment plan a percentage point or two. Go from 10% to 12%. If you get a raise, a bonus, a gift from grandma, or a tax refund during this period, try putting in even more. And always be on the lookout for ways to cut expenses, including taxes. That important strategy frees more money for investments as well.

Step 10: The best tax shelter there is

If you think there’s no free lunch, think again. The government actually pays for part of your home mortgage interest by letting you deduct the entire thing from your income tax. Home ownership is the single biggest tax shelter available to the regular guy. Down payments can be challenging, but talk to your bank about special loan programs and rates they may offer. Consider starting with a small condo and moving up. If you’re handy, go with a fixer-upper. Anything to get started. In a very real way, a house is a savings account that you live in.

Home ownership isn’t a slam-dunk, however. If you move a lot, working your way up the career ladder, you may occasionally lose money. But, like investing in stocks, if you do your homework, you’ll come out ahead more often than not. It’s a big step, but to help you make such an important decision, try this exercise: before making out next month’s rent check, write down all the good reasons you can think of for wanting to lower your landlord’s tax bill and not your own.

Step 11: The biggest risk of all

If I’ve done my job convincingly, by now you want to know much more about personal finance. All the big mutual fund companies have investment guide books they’d love to send you. Magazines like Money and Kiplinger’s are targeted to beginning and intermediate investors. There are simply written, information-rich books such as Mutual Funds for Dummies, The Wealthy Barber by David Chilton, The Motley Fool Investment Guide, and You Have More Than You Think by David and Tom Gardner. Or pick up anything at all by Jonathan Pond. On the Internet, check out morningstar.net, or investorlinks.com, which is a portal site that offers more than 50 links including a “top sites” list of the month’s most frequented financial sites. Please go learn more.

Earlier we spoke of the connection between risk and reward. The riskiest, most dangerous thing you could possibly do with all this advice and information is nothing. You could decide not to decide. Think about it tomorrow. Can’t be bothered now. I’m way too young to worry about this stuff. I’ve got all the time in the world.

But it’s precisely because you have time that now is the best time to harness it, to put it to work for you. So make a start, however small, and keep it up. Pay yourself first with the “10% off the top” habit of investing and watch your small stash grow into an investment portfolio you can really benefit from. Admittedly, you have more time power on your side if you’re 22 than 42, but there is never a time when you can rightly say, “It’s too late.” So take action right now. Make it a way of life, beginning today. And as Dad might say in closing, someday you’ll thank me for this.